When you transfer money to your friend’s account, ever wondered how it works? What actually happens behind the scenes? Chances are you have already used ACH payments, but are not familiar with the jargon. Some of the examples of ACH transactions include:

- Online bill payments through your bank account

- Transferring money from one bank account to another

- Paying vendors or receiving money from customers via direct deposit

- Direct deposit payroll to an employee’s checking account used by companies

Let’s explore ACH payment processing more in detail.

What are ACH Payments?

ACH payments (also known as ‘direct payments’) are electronic transfers from one account to another that are processed through the Automated Clearing House (ACH) Network. The ACH network of financial institutions (banks and credit unions) facilitates transactions in the United States and is managed by National Automated Clearing House Association (NACHA).

According to NACHA, ACH payments per day exceeded 100 million in February 2019. The latest figures from NACHA revealed a 7.1% increase in ACH transaction volume for the first quarter of 2020, with B2B payments posting an 11.7% volume increase in Q1 of 2020 and accounting for 1 billion transactions.

‘Automated Clearing House’ or ACH is basically a central clearing system. For instance, you transfer money to a Silicon Valley Bank account from your Bank of America account. And someone does an inverse transaction as well. Both the banks have to credit and debit each other’s accounts. An instant credit/debit process for each transaction might sound faster, but has a lot of underlying drawbacks.

The solution? A central clearing system, which keeps track of how much each bank owes each other and at the end of each day, processes the transactions in batches. This way, the fund transfer happens just once. ACH is one such central clearing system for banks in the US. It operates via two clearing facilities: the Federal Reserve banks and The Clearing House.

So How are ACH Transfers Different from Wire Transfers?

Wire transfers are interbank electronic payments. While wire transfers seem to be similar to ACH transfers, here are some key differences between them:

| ACH Transfers | Wire Transfers | |

| Speed | Can take a few business days | Instant |

| Cost | Free for a receiver, nominal fees ($1) for a sender | Both the sender and receiver are charged fees. Average fees under $14 for domestic and upto $75 for international transfers. |

| Cancelation Terms | Can be disputed if conditions are met | Once initiated, cannot be canceled/disputed |

| Human Intervention | No human intervention | Usually involves bank employees |

| Send/request payments | Both send and request payments. For payment requests, you need to upload the ACH file to your bank. | Only send payments |

| Process | Processed in batches | Processed real-time |

A wire transfer is ideal for you when time is of the essence, while ACH processing is a better option for non-mission-critical and recurring payments.

How Does ACH Payment Processing Work?

Now in any transfer, two people are involved. One who pays and one who gets paid. In ACH terms, they are called the originator and the receiver.

An ACH Debit occurs when a customer authorizes the merchant to make a transaction. On the other hand, when money actually gets deposited into a Receiver’s account, it is called an ACH Credit.

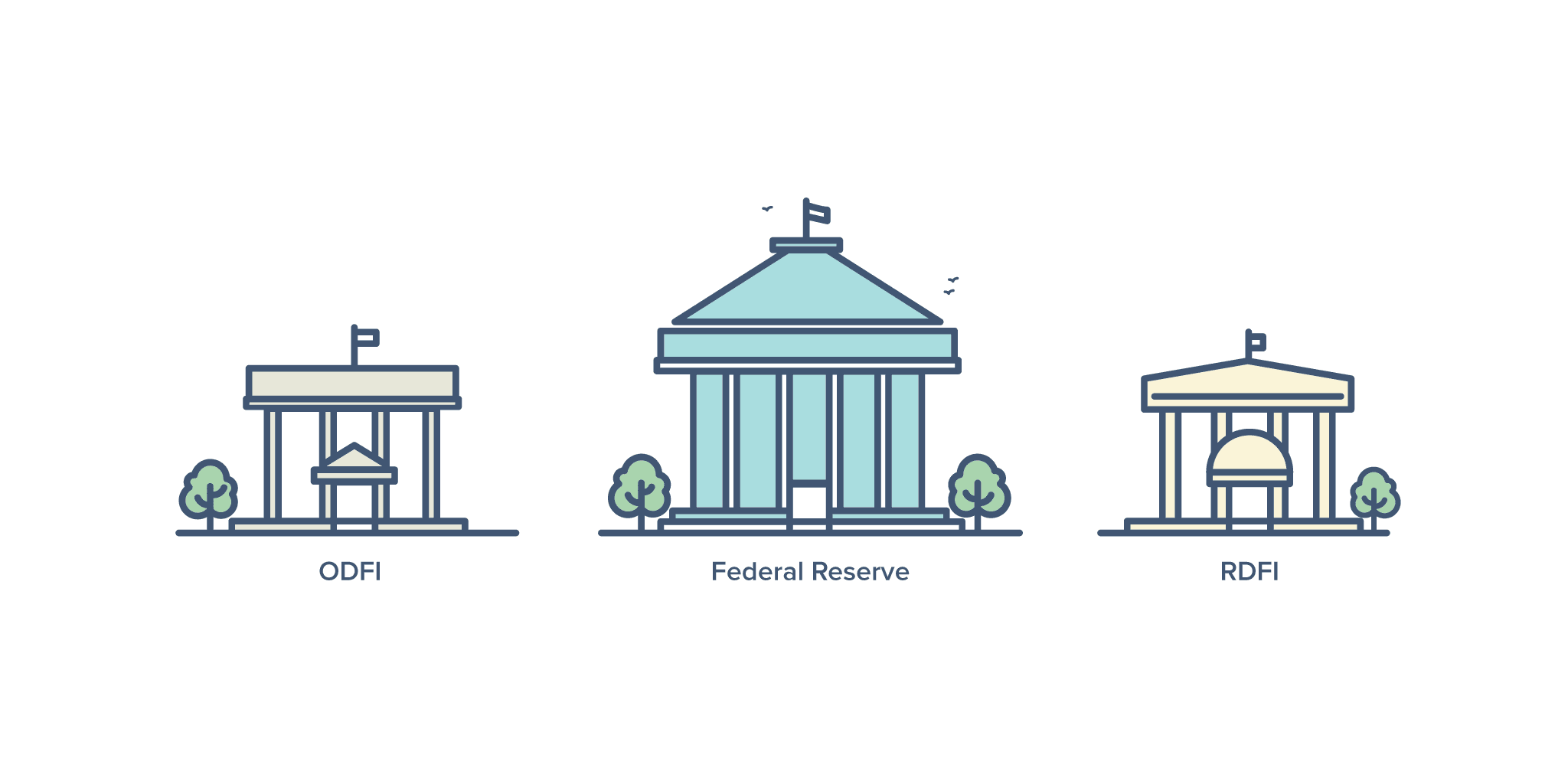

There are two corresponding banks involved in the transaction: Originating Financial Depository Institution (ODFI) and the Receiving Financial Depository Institution (RDFI).

In the B2B world, if you run a SaaS company, your bank (your gateway’s bank typically) would be the ODFI, while your customer’s bank would be the RDFI. Your customer authorizes you to debit their bank account on his behalf for recurring transactions.

Let’s say Jekyll has to pay a sum of $100 to Hyde (assume they’re two different people) and decides to make an electronic transfer. Here is a step by step breakdown of how a bank transfer via ACH works.

- The originator (Jekyll) goes to his bank (the ODFI) to initiate a transaction.

- He is asked to submit checking account information like the bank account number, the routing number of the receiver (Hyde). These are called ACH files.

- The ACH files contain a lot of specifications and formats, but they mainly have the receiver’s bank information and amount of the transaction.

- The ODFI then debits Jekyll’s account.

- At the end of the day, the ODFI aggregates all the ACH files and sends them to the ACH network (The Federal Reserve).

- The Federal Reserve then sorts all the ACH files and then routes it to the receiver’s bank – the RDFI.

- The RDFI then processes the ACH files and credits the receiver’s (Hyde) account with 100$.

The example above is that of when Jekyll pays Hyde. If Hyde has to pay Jekyll, the same process happens in reverse. In such cases, if Hyde has insufficient funds in his account, the RDFI processes a return. The RDFI uploads the return ACH file to the ACH network, along with a reason code for the error. A return may be processed also due to various other reasons like an invalid account number etc.

ACH Payments for SaaS Businesses

ACH payments can serve as a great option for SaaS businesses. Here are some key points to keep in mind when choosing ACH for your SaaS:

Built for Recurring Payments

Although the usage of paper checks has dropped to a great extent, many enterprise companies still use checks to pay every month in order to avoid the huge chunk of processing fees. ACH, a digital form of checks, came into picture to reduce the overhead of managing paper checks. With ACH, since the transaction processing is recurring and automatic, you wouldn’t have to wait for a paper check to arrive. Also, since customers have authorized you to collect payments on their behalf, the flexibility of it allows you to collect one-time payments as well. No more awkward emails asking customers to pay up.

Reduce Involuntary Churn

Failed payments continue to be one of the main reasons for churn. Credit card payments fail due to various reasons such as expired cards, blocked cards, transactional errors, etc. Sometimes the customer could have exceeded the credit limit and that could have led to a decline.

In case of a bank transfer via ACH, the bank account number is used along with an authorization, to charge the customer and unlike card transactions, the probability of a bank transfer failing is very low. Checking accounts do not ‘expire’ like debit cards and credit cards. Account numbers rarely change. Also, unlike card transactions, bank transfers fail only for a handful of reasons such as insufficient funds, wrong bank account information, etc.

Also, the two-level verification process for ACH payments, ensures that you maintain a touchpoint with customers. This factors in for churn due to unknown reasons.

Checkout Process – Credit Card vs ACH Payments

There is a slight variation in the checkout process of any online payment such as a credit card, as compared to that of payment via ACH.

Generally, for a customer to pay via ACH, there is a double check process in place. The customer first raises a request to pay via ACH and then, after verifying the customer, ACH as a payment option is enabled for the particular account. Only then, can a customer make a direct debit payment via ACH. This verification includes checking the validity and legitimacy of the bank account. This mitigates the potential risk of fraudsters and avoids ACH returns. This secure process makes ACH a trustworthy option.

If you’re considering ACH, head here to know how to accept ACH debit payments as an online business.

The Economy behind Transaction Fees

For each credit card transaction, a percentage of the money involved is split across the various entities which enabled the payment. A major chunk of this fee is the Interchange fee.

This Interchange fee is set by the credit card networks like Visa, Mastercard, etc. and is typically up to 2% of the total transaction fee.

But in case of a transaction routed via the ACH network, since it directly deals with the banking network, the interchange fee is around 0.5-1 % of the total transaction.

Here’s some quick math with some general percentage rates to make things simpler:

Let’s say you have an enterprise customer who pays you an annual subscription fee of $10,000.

On an average, you would pay 2.5% of the transaction value + $0.30 towards transaction fee. So, for a $10,000 transaction, you will pay (0.025*10,000) + 0.30 = $250.30.

The fee for a typical ACH transaction ranges somewhere around 0.75% per transaction which would be $75. And that’s $175 saved.

P.S. The actual TDR (Transaction Discount Rate) for ACH varies according to the payment gateway used.

Driving Adoption of ACH

So despite having lower transaction costs, why are ACH payments not as widespread as credit cards? Let’s look at the basic differences between ACH and Credit cards.

| ACH Payments | Credit Cards |

| Smaller transfer fees (usually around $0.50 per transaction) | Larger transaction fees (2.5% to 3.2% per transaction) |

| Payments are not automated | Automated payments |

| Take more time | Take less time |

| Process intensive and hence not as easy to use | Easy to use |

ACH costs less and is of great value to merchants but the challenge is getting a large number of users onboard with ACH.

With the lucrative incentive programs of credit cards such as reward points and other perks, a consumer would need a really strong reason to switch to ACH payments.

Freelancing platform Upwork has used interesting strategies to drive ACH adoption. They charge 3% more on the credit card transactions. Moreover, they charge high volume (more than $1000) users with only $30 flat fee for unlimited ACH transactions.

You can drive increased adoption of ACH payments over the long term by incentivizing consumers using rewards and perks.

Head here to read more about the benefits of ACH payments for online businesses.