For any business, big or small, account reconciliation is a mandatory process. It is the process of comparing internal financial statements to external financial statements from banks or other financial institutions to ensure that everything is correct and in agreement.

Reconciliation is an age-old process typically carried out by accountants who spend a long time cross-referencing records at the end of every accounting period to make sure the records match and are accurate. On the flip side, a manual approach to reconciliation is not only time-taking but error-prone, putting companies at risk of overspending, being unable to pay employees or suppliers on time, and less likely to detect fraudulent activities.

However, this doesn’t have to be the case. There is a way to increase the functionality of reconciliation – with the help of automation.

The Necessity of Automating Account Reconciliation

While you’re busy growing your business, your general ledger is bound to get data-heavy, increasing the time taken to reconcile records and the possibility of making errors due to the lack of foolproof processes in place.

And this is where automation comes in handy.

Imagine you’re a growing business with operations in multiple countries, dealing with various currencies. This scenario can lead to an increase in errors and complexities for your team. However, by utilizing a robust software solution like Chargebee, you can implement Smart Routing Rules that automatically select the appropriate payment gateway based on the currency used for each transaction. When it comes time to reconcile your accounts in the general ledger, Chargebee seamlessly converts all currencies into your company’s standard currency. This eliminates the need for manual conversion by your finance team and streamlines the reconciliation process. Additionally, this level of automation simplifies the customer experience by removing the step of converting prices into their local currency. By leveraging such advanced automation tools, businesses can not only save time but also ensure accuracy and efficiency in their financial processes.

No matter how efficient and thorough a business’ finance team is, it will always lag behind finance teams that use reconciliation automation software. The pain points to manual reconciliation are many – not only will it be time-consuming and error-prone but also an expensive affair – which can result in potentially major financial consequences for the company. Add in high transaction volumes, multiple bank accounts, transaction types, currencies, and bank file formats – the situation is only exacerbated. The use of automated and/or customized reconciliation software provides a cost-effective alternative to time-consuming and error-prone manual reconciliations.

Benefits of Account Reconciliation Automation

- Standardized Process — account reconciliation software will automatically run reconciliation at the end of every accounting period; leading to a faster and easier financial close process, improving accuracy and insights, freeing time for the finance team to focus on higher-level objectives

- Minimized Errors — enhanced internal controls allow for seamless functioning, ultimately reducing mistakes

- Recorded History — all history of reconciliation is stored, making it useful for audits and compliance

- Delegated Responsibility — the software will allow you to assign roles and manage access; the approval process becomes swifter.

For more on account reconciliation, the importance of automating it, and how to automate it, read our blog: It’s Time to Automate Your Most Error-Prone Process: Reconciliation

Features of an Account Reconciliation Software

Here are the top features to look for while purchasing a reconciliation tool:

-

Cloud-Based

Cloud-based SaaS solutions, as opposed to on-premise solutions, ensure quicker product deployment, easier access to product support, and facilitate updates and bug fixes.

-

Task Flow

Task flows help in managing the sequence, completion, and review of processes, maintaining visibility of them, and providing the necessary governance to demonstrate their completion. They allow you to retain a history of all accounts reconciled at your fingertips, as opposed to sifting through a file cabinet.

-

Reporting

Dashboards are a common feature across accounting tools and provide instant visibility in tracking KPIs and the number of unreconciled transactions and accounts. This feature is vital for an in-depth understanding of your data.

-

Group Suitability

Some systems are better than others at handling group-wide balance sheet reconciliations. Such systems will have to deal with multiple entities, each with its own currency, configuration, workflows, security access, approval rules, and so on, all of which must be reconciled to the consolidation system.

Will the solution allow federated collaboration between each user in their respective locations with central oversight, or will it have to be performed by a single, central person/team? The former usually results in greater efficiency.

-

Postings

While it’s great that your balance sheet reconciliation process identifies errors, it isn’t of use if the software cannot correct them. Is there a direct posting link that can transfer corrected journal entries back to the general ledger?

-

Data Acquisition

A reconciliation automation tool needs

- a powerful software so the system doesn’t strain under the load of matching a high volume of transactions at a fine level of granularity

- to incorporate system links to internal and even external data sources to efficiently handle large volumes of data processed daily.

-

Matching Techniques

Transaction matching depends on the sophistication of the matching tool – the ability to write your own matching rules, with the system supporting value, percentage, and combination thresholds.

-

Matching Interface

Transaction matching rules need to be continually enhanced over time. A tool that provides a user-friendly interface for writing rules can improve the transaction matching rate to maximize efficiency and keep a system relevant in the organization.

Best Account Reconciliation Tools in the Market

Now that we’ve covered the necessity of reconciliation automation and the features to keep an eye out for, let’s look at a few of the best account reconciliation solutions you can consider purchasing:

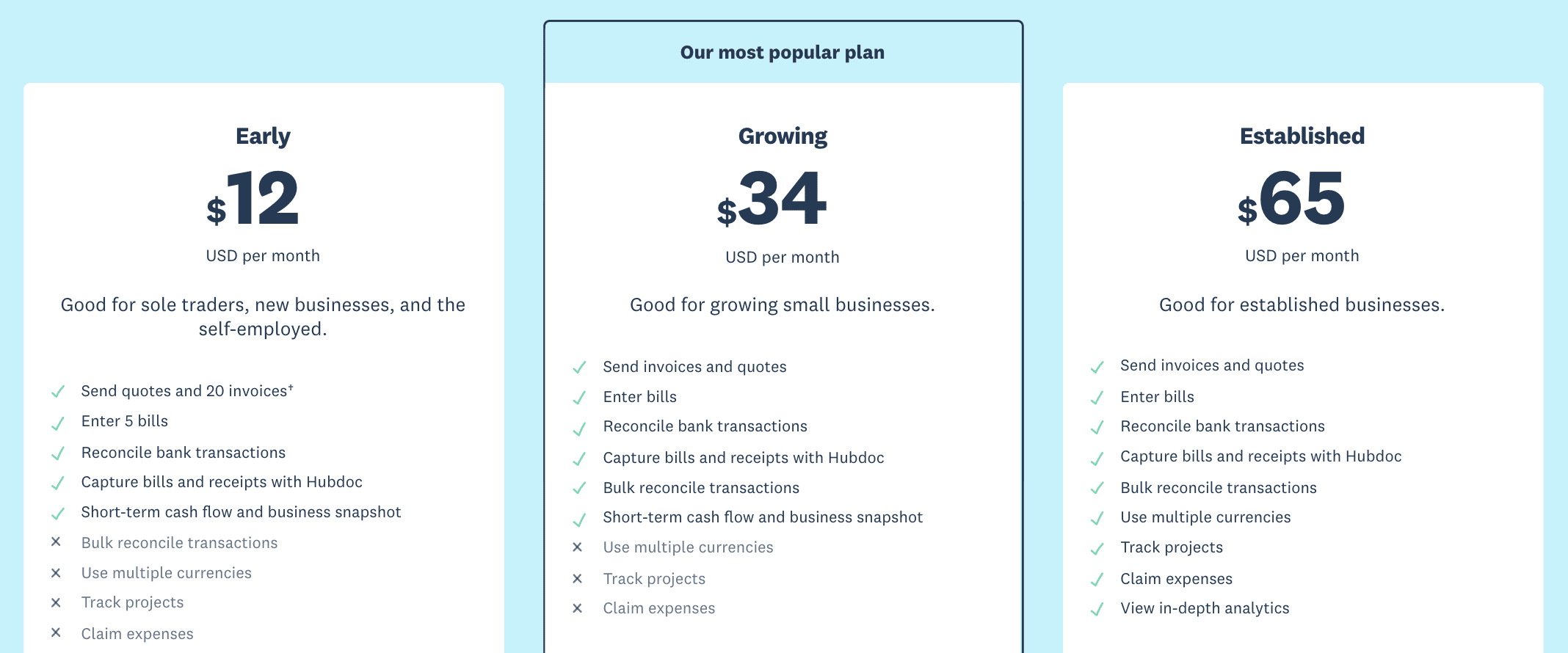

1. Xero

Xero is, at its core, a simple but powerful accounting software. The tool is well-designed for medium to large-sized businesses. One of its most significant advantages is that all plans include unlimited users. Xero automatically imports bank transactions every working day, sets up rules to automatically match bank transactions to invoices, creates routines, groups similar transactions, and more for the reconciliation process.

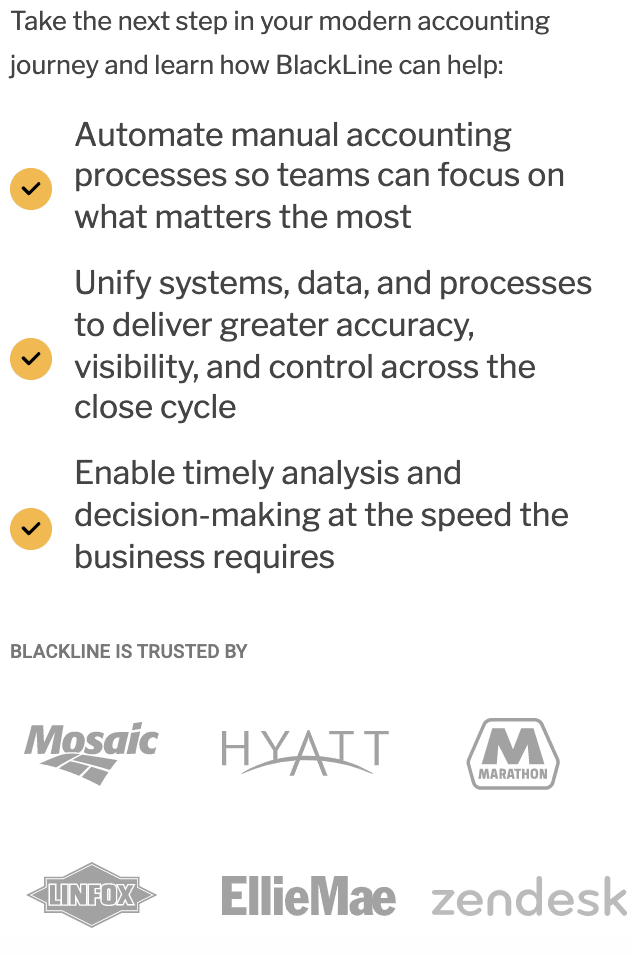

2. Blackline

Blackline is a cloud-based software system that includes features for managing the financial close process, such as reconciliations and accounting automation. It provides reconciliation tools such as standardized templates, approval and review processes, procedures, policies, and workflows for preparation. Furthermore, the integration option enables you to save supporting documents in the cloud. Users can view account reconciliation details, add text fields, and upload supporting documentation.

3. ReconArt

ReconArt combines bank reconciliation software and a management suite to streamline your finance and accounting reconciliation processes. It is entirely web-based and can be hosted on-site as well. The software is designed to help you leverage best practices for all aspects of reconciliation, such as bank reconciliation, credit card reconciliation , balance sheet reconciliation, financial close, accounts reconciliation, variance analysis, journal entry, and intercompany reconciliation. While there isn’t a free version, ReconArt is available for purchase with a minimum of five to ten users (depending on the plan) for $1,500 per month.

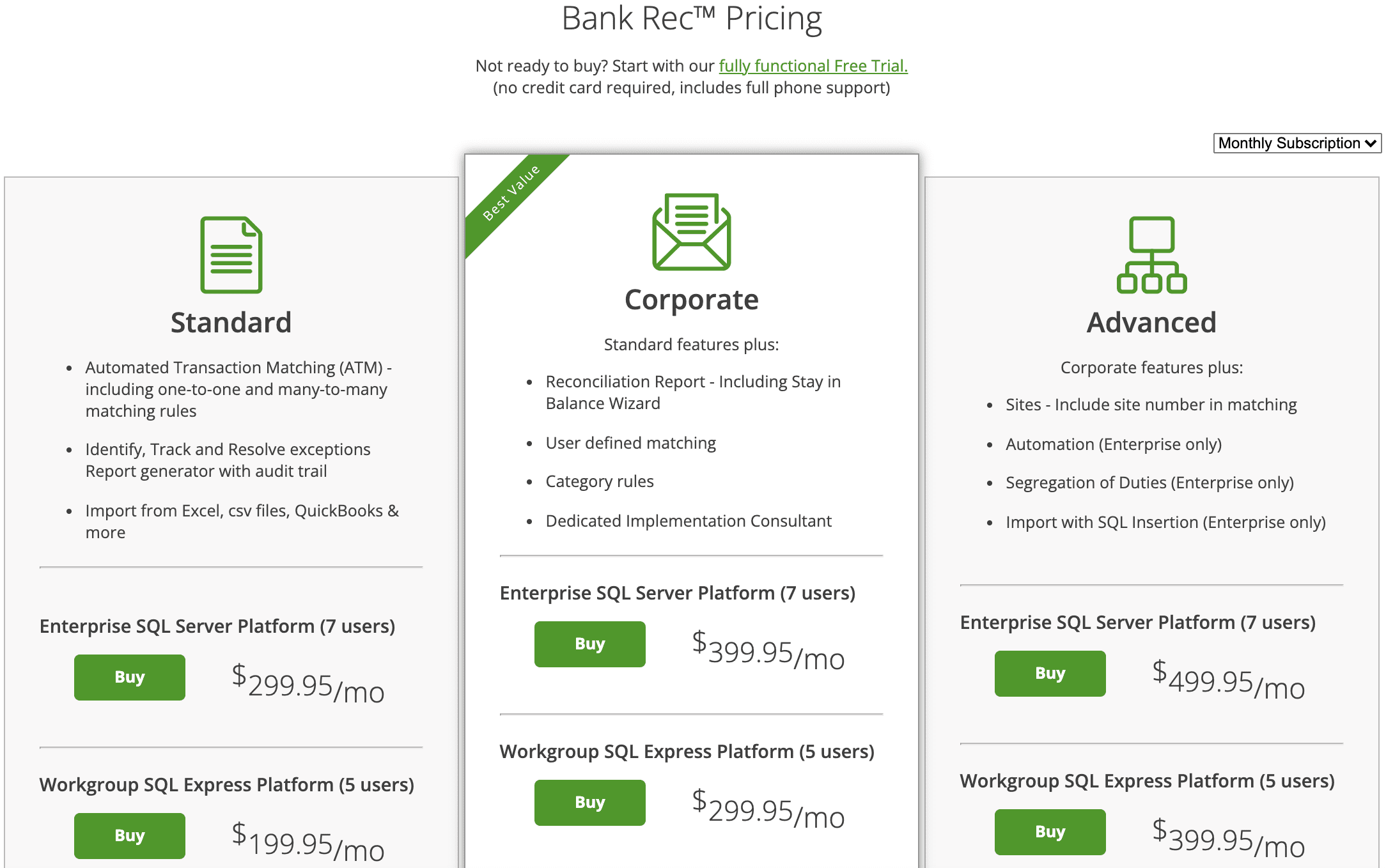

4. Bank Rec

Bank Rec helps you reconcile all of your bank accounts quickly and easily by providing high-speed automated transaction management. Customized matching rules relieve your staff of time-consuming tasks, and unmatched records can be easily rolled forward to the next period required until matched. Among the features of the tool are: identifying, tracking, and resolving matches, recording type classification, importing and automation, and high-speed account matching. It can also generate period-specific reconciliation reports with historical data. If necessary, everything can be exported to Excel. You can use exception reporting to determine why a record did not match your ledger. You can also use the Point and Click option to track unmatched items and resolve the issue.

5. AutoRek

AutoRek assists businesses in simplifying data collection, validation, and reconciliation while also providing the transparency and governance required for a comprehensive, automated reporting process. Its deployments range from complex inter-company reconciliations to high-volume bank processes and are used by many of the world’s largest corporations. The solution is a purpose-built, fully scalable reconciliation tool that includes all of the necessary components; their largest reconciliation deployment processed up to 2.4 billion transactions per hour.

AutoRek primarily serves the financial services industry, working with numerous large banks, asset managers, and insurance companies.

5. One Stream

The OneStream Account Reconciliation Tool automates and streamlines the account reconciliation process, helping businesses achieve faster and more accurate financial close. It integrates seamlessly with OneStream’s financial data, providing real-time updates and linking reconciliations directly to financial statements. The tool offers configurable matching rules, variance analysis, and exception management, allowing finance teams to identify and resolve discrepancies efficiently. Centralized dashboards and audit-ready documentation enhance oversight and ensure compliance with regulatory requirements. By reducing manual tasks and increasing accuracy, OneStream enables organizations to improve efficiency and maintain better control over their financial close processes.

Other popular tools include Cashbook, Duco, and more.

In Conclusion

Making wise business decisions is directly correlated to having an up-to-date view of your company’s cash flow, which is directly correlated to accurate account reconciliation. To save yourself time and stress from the frequent risk of errors – automating the reconciliation process is a must. And why wouldn’t you choose to automate, given that the benefits are undeniable?

For instance, Chargebee can help with reconciliation as it integrates with popular accounting tools. Bridge the gap between the bank and your books with the Chargebee + Xero integration. Chargebee has a Google Chrome extension that lets you automate reconciliations without having to click OK 100s of times.

You’ll be able to:

- Sync all of your customers, plans, coupons, invoices, taxes, and payments, among other things.

- View all updated transaction details that synced to Xero, including the Accounts Receivable report, balance sheet, and more.

- Easily reconcile with the bank statement, match payments to their correct, corresponding invoices.

- Generate tax liability reports and file returns with your local tax authorities, using Xero.

- Also – Stripe payments, transfers, and fees are automatically reconciled!

Finally, ensure that you choose a solution that scales with your company, like Chargebee. If you want to check out what we have to offer, here’s more information on how Chargebee can help automate reconciliation. You can also take the product for a spin with our free trial.